The Emergence of Oral GLP-1 Therapies: A Weak Signal Set to Disrupt Weight Loss and Chronic Disease Management

Recent advancements in glucagon-like peptide-1 (GLP-1) therapies, particularly the development and anticipated approval of oral formulations, represent a subtle yet transformative shift in pharmaceutical treatment paradigms. These developments are expected to significantly alter patient access, healthcare delivery, and sector economics across obesity, diabetes, and cardiovascular disease management. What appears as an incremental change — shifting from injectable to oral GLP-1 drugs — may catalyze broader systemic disruptions with far-reaching implications beyond weight loss markets.

What’s Changing?

Since 2021, injectable GLP-1 therapies have gained prominence as effective treatments for obesity and type 2 diabetes, with drugs like Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound driving strong market growth. However, recent pipelines indicate that oral GLP-1 formulations are nearing regulatory approval and will likely reshape usage patterns significantly.

For instance, Novo Nordisk’s investigational drug CagriSema, combining the amylin analog cagrilintide with semaglutide (a GLP-1 receptor agonist), is expected to face an FDA decision in 2026. This combination therapy aims to surpass weight loss outcomes delivered by GLP-1 monotherapy alone, signaling a shift towards more effective multi-mechanism regimens (Drug Discovery News).

In parallel, Eli Lilly is on track to launch an oral GLP-1 agonist — orforglipron — poised to provide patients with a convenient alternative to injections. This oral option could dissolve barriers related to administration discomfort and diet restrictions associated with injectable versions (Altitude Medicine).

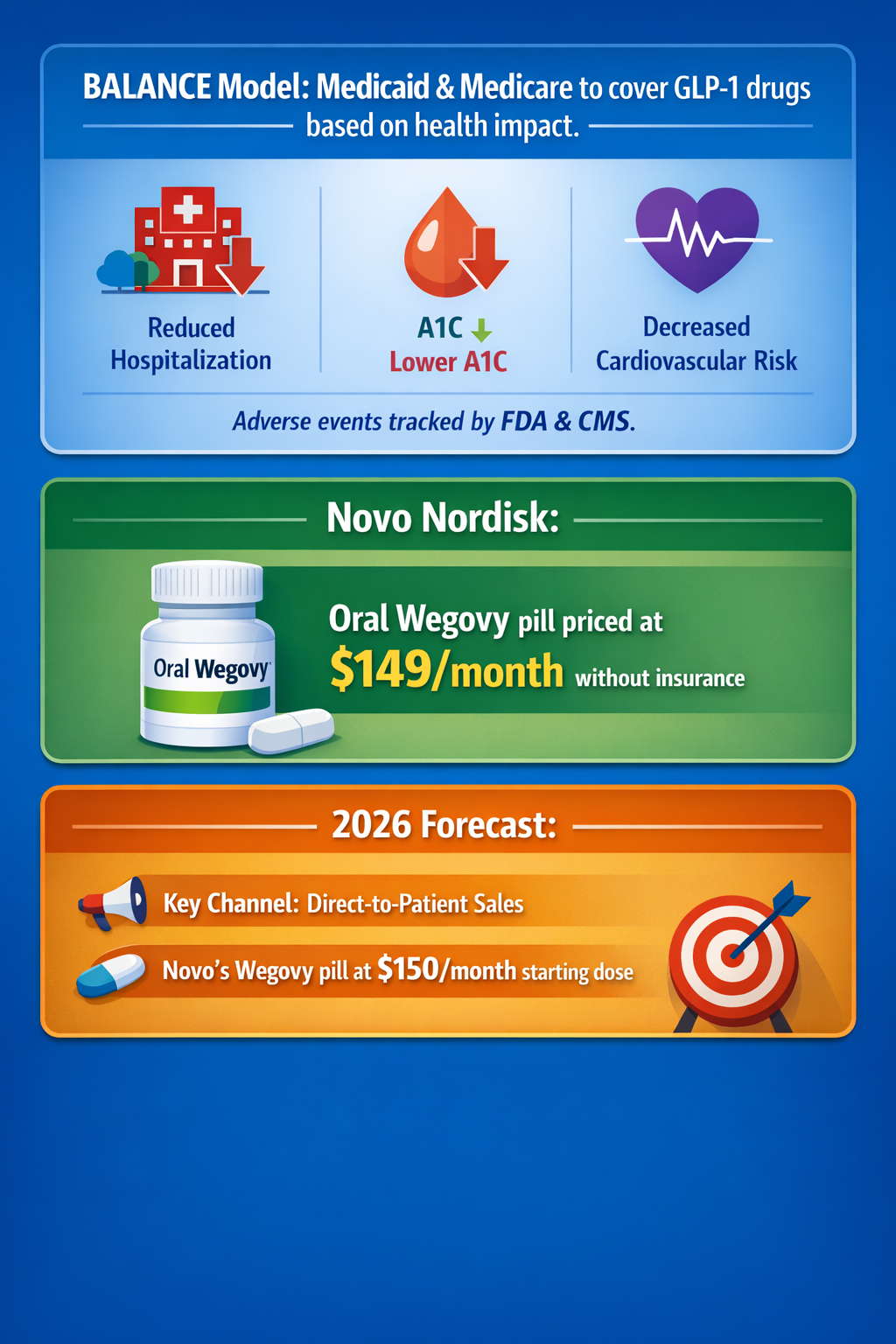

Both companies—Novo Nordisk and Eli Lilly—also have oral versions of their flagship drugs preparing for launch. Novo plans to sell its Wegovy pill at approximately $149 monthly without insurance direct to patients, reflecting a novel distribution model aimed at bypassing traditional insurance reimbursement complexities (ABC News).

Moreover, the anticipated roll-out of the BALANCE model, which proposes tying federal Medicaid and Medicare GLP-1 drug coverage to measurable health outcomes such as hospitalization reductions, risk lowering for cardiovascular disease, and glycemic control, signals a move toward value-based care anchored by real-world data and government oversight (Popular Rationalism).

Together, these developments reflect a subtle but significant inflection in how weight management and metabolic diseases may be treated in the next 5 to 20 years:

- The rise of oral GLP-1 therapies will increase patient compliance and expand treatment eligibility.

- Combination therapies such as cagrilintide with semaglutide could redefine efficacy standards for weight loss pharmaceutical interventions.

- Direct-to-patient sales models may disrupt traditional pharmacy and insurance channels, reducing transaction friction but raising questions about equitable access.

- Value-based reimbursement schemes tied to measurable outcomes may reshape payer-provider dynamics and influence pharmaceutical innovation incentives.

Why Is This Important?

This emergent trend may have multi-sector implications beyond immediate patient care. Oral GLP-1 formulations increase the likelihood of wider adoption for weight loss and diabetes management therapies, potentially shifting demand patterns and resource allocation within healthcare systems. This expansion could reduce obesity-related complications and diabetes-induced morbidity if managed systematically.

Pharmaceutical companies stand to see shifts in competitive dynamics, with oral drugs lowering entry barriers for new market participants and reshaping market share between incumbents. This may intensify innovation races, with heightened emphasis on combination treatments and oral bioavailability technologies.

Healthcare providers might face changed clinical workflows, emphasizing ongoing patient monitoring to align with outcome-based payment models such as the BALANCE initiative. Furthermore, insurance payers and government programs could pivot toward outcome validation systems, incorporating real-world evidence and risk stratification analytics.

On the social front, expanding access to oral therapies may reduce stigmas associated with injectable treatments and broaden patient demographics engaged in proactive weight and metabolic management. Conversely, costs and reimbursement complexities may inadvertently create disparities if regulatory mechanisms fail to ensure affordability and access equity.

Implications

The convergence of oral GLP-1 treatments, combination pharmacotherapies, direct-to-patient sales, and outcome-based reimbursement models will likely disrupt existing industry frameworks and societal health management:

- Healthcare Providers and Systems: Adoption of oral GLP-1 pills will require adaptation in clinical protocols emphasizing patient adherence, digital health monitoring, and data sharing to satisfy emerging reimbursement requirements. Providers may need to develop new competencies in interpreting outcome data linked to therapeutic effectiveness.

- Pharmaceutical Industry: Manufacturers must innovate beyond efficacy to address formulation convenience, patient experience, and real-world value demonstration. Partnerships with digital health platforms could become increasingly prominent to support data-driven care models.

- Insurance & Payers: Outcome-based payment models, as piloted in the BALANCE program, may become standardized, prompting payers to develop robust data infrastructure and audit capabilities to measure drug impact precisely. This also pressures drug pricing strategies to align with demonstrated value.

- Patients and Society: Improved access and ease of treatment may increase treatment initiation and adherence, potentially improving population health outcomes. However, attention to cost and equitable distribution will be vital to avoid exacerbating existing health inequalities.

- Regulators: Approvals for combination therapies and oral forms introduce complexities around safety monitoring, adverse event tracking, and long-term outcomes assessment, necessitating enhanced post-market surveillance and coordination with payers.

These implications suggest that while oral GLP-1 drugs may seem like a narrow pharmaceutical innovation, they could significantly disrupt the ecosystem surrounding obesity and metabolic disease management across sectors.

Questions

- How will healthcare providers integrate outcome-based reimbursement requirements into clinical workflows while maintaining patient-centered care?

- What strategies can pharmaceutical companies employ to balance innovation in drug development with affordability and access in competitive markets?

- How might direct-to-patient sales models impact traditional pharmacy networks, insurance negotiations, and healthcare equity?

- What new data collection and monitoring infrastructures are necessary for capturing real-world outcomes tied to therapy effectiveness?

- In what ways could value-based reimbursement models influence pharmaceutical research priorities beyond weight loss and diabetes?

Answering these questions could help strategic planners and decision-makers across industries anticipate and shape the trajectory of this evolutionary shift in chronic disease pharmacotherapy.

Keywords

oral GLP-1 therapies; combination pharmacotherapies; weight loss drugs; value-based reimbursement; direct-to-patient sales; chronic disease management; real-world evidence

Bibliography

- Five drug approvals to watch in 2026. Drug Discovery News. https://www.drugdiscoverynews.com/five-drug-approvals-to-watch-in-2026-16982

- Top news in medicine for 2026. Altitude Medicine. https://www.altitudemedicine.com/2026/01/top-news-in-medicine-for-2026/

- First GLP-1 weight loss pill sales surge, boosting Novo stock market expectations. eMarketer. https://www.emarketer.com/content/first-glp-1-weight-loss-pill-sales-surge--boosting-novo-stock-market-expectations

- Weight loss drug market edges toward more crowded big pharma field. eMarketer. https://www.emarketer.com/content/weight-loss-drug-market-edges-toward-more-crowded-big-pharma-field

- Novo Nordisk and Lilly FDA approval, Wegovy pill launches new obesity battle. Morningstar. https://global.morningstar.com/en-gb/stocks/novo-lilly-fda-approval-wegovy-pill-launches-new-obesity-battle

- FDA approves Wegovy pill for weight loss. ABC News. https://abcnews.go.com/GMA/Wellness/fda-approves-wegovy-pill-weight-loss/story?id=128644712

- Looking forward: HHS 2026 and the BALANCE model linking drug coverage to health outcomes. Popular Rationalism. https://popularrationalism.substack.com/p/looking-forward-hhs-2026-and-the