The Emerging Role of Fourth-Party Logistics (4PL) Providers in Global Supply Chain Resilience

Global trade and supply chains face escalating pressures from geopolitical tensions, climate change, and accelerating technological transformation. While nearshoring and friendshoring reshape manufacturing geography, a subtler yet potentially disruptive force is rising: fourth-party logistics providers (4PLs). These integrators may become pivotal in managing increasingly fragmented supply chains by orchestrating multi-modal networks, data-driven risk responses, and agile sourcing strategies across regions and industries. This article explores this weak signal of change, its strategic implications, and how businesses and governments might navigate this evolving ecosystem.

What’s Changing?

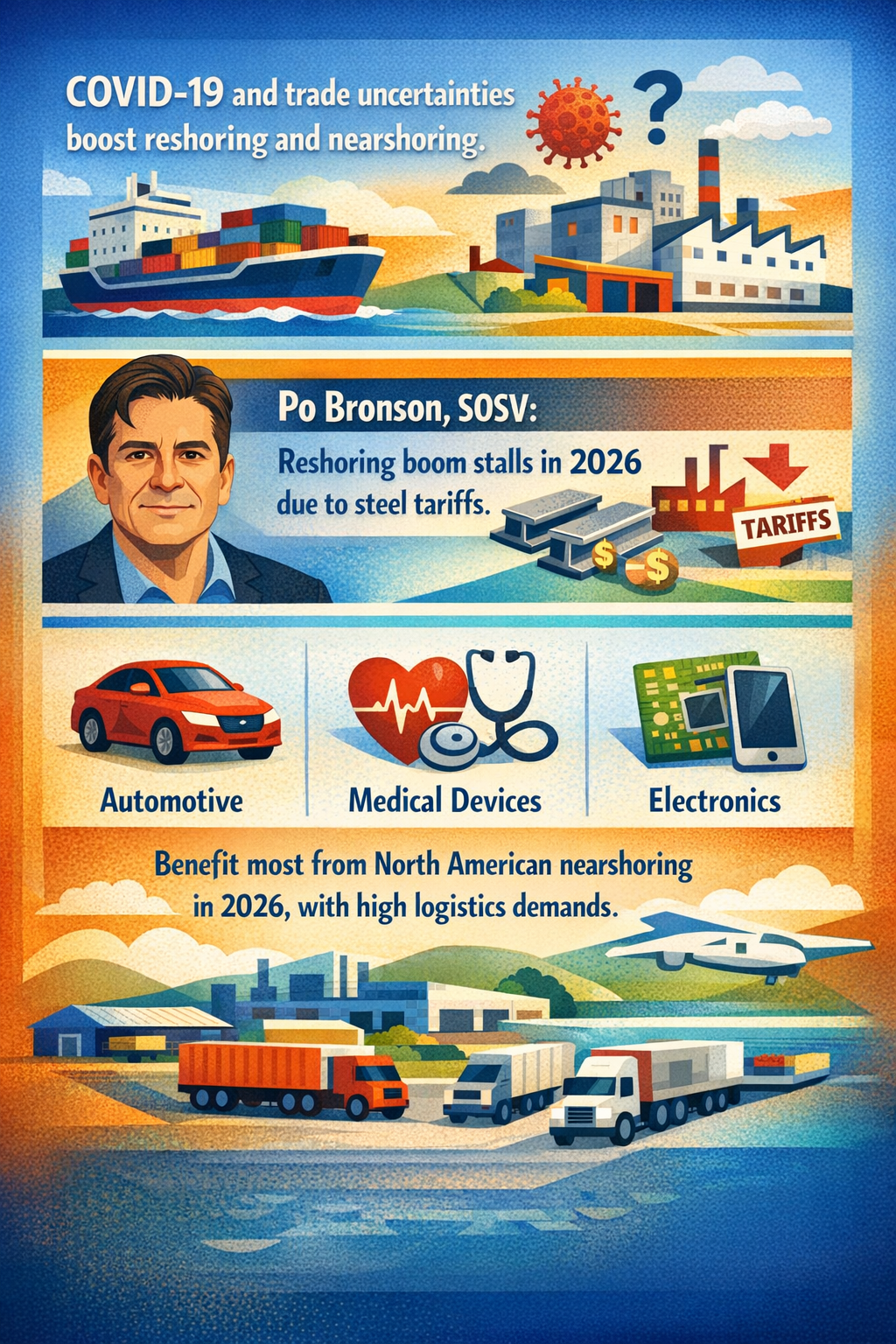

The global supply chain landscape is undergoing profound transformation. Nearshoring—the practice of relocating manufacturing closer to end markets—has accelerated notably in North America, especially in Mexico and Central America, as firms seek to reduce lead times, transportation costs, and vulnerability to overseas disruptions (ITSTraffic, 2026). Concurrently, friendshoring and regionalized manufacturing strategies are realigning demand corridors, with firms looking to diversify supplier bases beyond traditional hubs in Asia to buffer geopolitical volatility, particularly between the U.S. and China (FTI Consulting).

While these shifts reshape production, they introduce complexity into supply chain coordination. Fragmentation intensifies as manufacturing nodes spread across multiple countries, with varying regulatory regimes, infrastructure challenges, and political risks. In response, fourth-party logistics providers (4PLs)—entities that assume end-to-end responsibility for supply chain management beyond traditional third-party logistics (3PL) functions—are emerging as critical players. Unlike 3PLs, which typically handle logistics execution, 4PLs integrate supply chain design, technology, data analytics, and partner management, effectively acting as orchestrators of complex, multi-stakeholder networks (AINvest).

Recent strategic imperatives push firms to reconsider the resilience of their supply chains amidst increasing climate risk, trade uncertainties, and a digital transformation wave embedding advanced analytics and real-time monitoring. This environment favors 4PLs that specialize in leveraging digital platforms and intelligence to predict disruptions early, optimize multi-leg routes, and coordinate contingency plans across geographically diverse suppliers. The U.S.-China rivalry reinforces this dynamic, as technology blocs and export controls demand agile, locally compliant supply chain configurations (Evrimagaci).

Additionally, the increasing complexity of critical mineral sourcing—such as lithium for electric vehicles—is driving strategic supplier relations spanning the Americas, Asia, and Europe. Managing such cross-domain dependencies often extends beyond the capabilities of traditional logistics providers, elevating 4PLs capable of integrating upstream mining with downstream manufacturing and distribution (Farmonaut, 2026). Here, 4PLs could evolve into intelligence nodes, optimizing material flows on a mine-to-magnet model while balancing geopolitical risk and sustainability goals (IEEE Spectrum).

Finally, talent and technology investments in digital supply chain platforms—incorporating AI, blockchain, IoT sensors, and predictive analytics—are likely to give the most sophisticated 4PLs a competitive edge. They can simulate scenarios, anticipate disruptions, and provide clients with actionable foresight rather than reactive logistics services alone. This change foreshadows a shift from operational logistics to strategic intelligence in supply chain management.

Why is This Important?

The rise of 4PLs as integrators of fragmented and regionally diversified supply chains could fundamentally alter industry structures by transforming how companies manage risk, costs, and agility. Unlike nearshoring or reshoring alone—which primarily affect production location decisions—the 4PL model addresses the operational and strategic complexities that emerge as networks decentralize.

This development may influence multiple sectors by enabling:

- Resilience optimization: Proactive risk assessment and dynamic re-routing could reduce downtime and inventory costs in volatile environments.

- Transparency and data sharing: Coordinated platforms can enhance visibility across supply chain tiers, improving compliance and sustainability reporting requirements.

- Geopolitical decoupling: Clients may more rapidly pivot suppliers and transport modes to navigate export controls or tariffs without disrupting end markets.

- Cross-sector collaboration: Integrating upstream (raw materials) with downstream (manufacturing and distribution) enables holistic management of complex product ecosystems like EV batteries or semiconductors.

For governments, supporting the growth of capable 4PL providers might be a strategic lever to sustain economic stability and maintain competitive industries amid global fragmentation. For businesses, partnerships with such integrators could become critical in managing supply chain complexity beyond the capabilities of internal teams or conventional 3PL contracts.

Implications

The evolving 4PL landscape invites multiple practical considerations for stakeholders:

- Investment in digital infrastructure: 4PL providers need access to advanced data analytics, AI-driven scenario planning, and blockchain-enabled traceability to deliver value. Firms should assess their current technology partnerships and plan for integration with evolving 4PL platforms.

- Reassessing supply chain governance: Entrusting end-to-end control to 4PLs implies new risk profiles, legal frameworks, and data-sharing agreements. Companies and regulators must design governance models balancing transparency, cybersecurity, and operational agility.

- Talent and expertise development: The skill sets required by 4PLs—combining logistics, data science, and geopolitical intelligence—may necessitate tailored workforce development strategies.

- Policy alignment and geopolitical awareness: Policymakers could consider encouraging 4PL ecosystem development as part of broader economic resilience strategies, especially in regions benefiting from nearshoring (e.g., Mexico), ensuring regulatory clarity and supporting innovation hubs.

- Cross-sector systems innovation: Leveraging 4PL intelligence for integrating mining, manufacturing, and distribution chains might stimulate novel cooperation models across industrial sectors, opening new investment and growth avenues.

Over the next 5 to 20 years, the 4PL paradigm could redefine logistics into a blend of strategic intelligence and operational orchestration. This approach might enable more adaptive supply chains inherently capable of coping with complex global dynamics, from climate shocks to shifting trade alliances.

Questions

To prepare for the potential rise of 4PL-driven supply chain resilience, strategic planners in business and government could explore these questions:

- How capable is the current supply chain architecture of integrating end-to-end visibility and scenario planning, and what gaps can 4PL providers fill?

- What regulatory or policy frameworks are necessary to facilitate secure data sharing and collaboration across supply chain tiers in a 4PL model?

- How might emerging 4PL services alter cost structures and competitive advantages in critical industries such as semiconductors, electric vehicles, and critical minerals?

- What digital investments and talent acquisition strategies are required to partner effectively with or become a leading 4PL provider?

- How can regional governments supporting nearshoring leverage 4PL development to maximize economic growth, supply chain resilience, and geopolitical autonomy?

Keywords

fourth-party logistics; 4PL; nearshoring; supply chain resilience; geopolitical risk; digital transformation; critical minerals; multi-modal logistics; export controls; intelligent supply networks

Bibliography

- Structural Realignment of Global Supply Flows - Nearshoring, friendshoring and regionalized manufacturing will alter demand corridors. FTI Consulting. https://www.fticonsulting.com/insights/articles/transportation-logistics-outlook-shock-strategic-reinvention

- Supply chain resilience: Strategic relations with US and Asian industry will diversify critical mineral sources, buffering volatility from geopolitical shifts. Farmonaut. https://farmonaut.com/mining/argentina-lithium-argentite-us-lithium-2026-trends

- PL providers are critical for enhancing global supply chain resilience amid geopolitical tensions, climate risks, and digital transformation. AINvest. https://www.ainvest.com/news/strategic-imperative-4pl-fragmented-global-supply-chain-era-2512/

- Looking ahead, experts agree that the next few years will see even more fragmentation as the U.S. and China harden their techno-blocs, with stricter export controls, increased investment in domestic manufacturing, and a relentless focus on supply chain resilience. Evrimagaci. https://evrimagaci.org/gpt/us-and-china-battle-for-ai-supremacy-in-2025-519824

- MP Materials' unique mine-to-magnet strategy could offer intelligence and supply-chain resilience, but competing with China's subsidies and scale will be extremely difficult. IEEE Spectrum. https://spectrum.ieee.org/top-ev-charging-stories-2025

- Nearshoring is reshaping freight flows across North America faster than many organizations anticipated. ITSTraffic. https://www.itstraffic.com/post/mexico-nearshoring-how-it-s-reshaping-north-american-logistics-in-2026